Here’s what the Fed will do — if it follows what Powell said at last

Get out your popcorn, and get your trading apps open — after months in the waiting, Federal Reserve Chair Jerome Powell is set to deliver remarks on the economic outlook at the Kansas City Fed’s Jackson Hole economic symposium.

Expect him to inch up to the line, but not quite announce, that the Fed will end its bond-buying program. The delta variant has supressed progress on a number of economic indicators, ranging from airline travel to purchasing manager gauges of activity, so Powell will have reason to say, let’s wait for another month or two of data before committing to a taper.

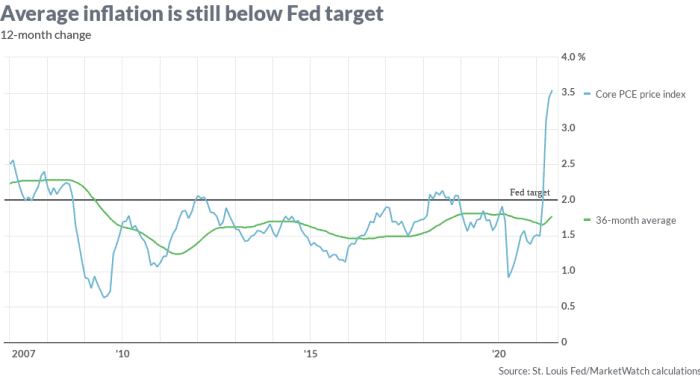

But there’s another reason why the Fed should wait — the framework that Powell himself introduced at last year’s Jackson Hole, called average inflation targeting. “We will seek to achieve inflation that averages 2% over time. Therefore, following periods when inflation has been running below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time,” he said in 2020.

Now Powell didn’t actually define the “time” element. If time means three years, inflation is still below target, as the chart shows. “It is needless to say that the hurdle rate for rate hikes due to inflation is extremely high under the new Fed framework and that this year’s US treasury rates move was unwarranted,” said Mondher Bettaieb-Loriot, head of corporate bonds at Vontobel Asset Management.

Bettaieb-Loriot may not be correct in his call that tapering’s unlikely before well into 2022; after all, during the July meeting in which “most” Fed officials said it would make sense to start reducing purchases, the 3-year rolling average of inflation was below target. Put another way, the Fed’s commitment to its new framework has been shaky. It will be interesting to see whether Powell makes a fresh commitment to it, or not.

The buzz

The Powell speech is due at 10 a.m. Eastern, and a gaggle of other policymakers will be interviewed on the major business news networks through the day. Ahead of that, there’s data on the PCE price index for July, as well as trade in goods data from July.

There were a number of corporate earnings releases delivered late Thursday. Gap

GPS,

surged as the retailer’s earnings came in well ahead of estimates, with online sales now representing a third of total revenue. Peloton Interactive

PTON,

shares slumped on the exercise bike company’s outlook and price cuts. Enterprise software provider VMware

VMW,

also slumped…

Read More: Here’s what the Fed will do — if it follows what Powell said at last