Opinion: Stock-market ‘internals’ are improving, so stay bullish on

The S&P 500 index

SPX,

continues to trade near all-time highs. The NASDAQ-100

NDX,

QQQ,

also is repeatedly making new all-time highs.

Meanwhile, market internals – while not wildly bullish – have improved for the first time about 10 weeks. That has resulted in some “catch-up” by the Russell 2000 index

RUT,

IWM,

but it is still well below its all-time highs.

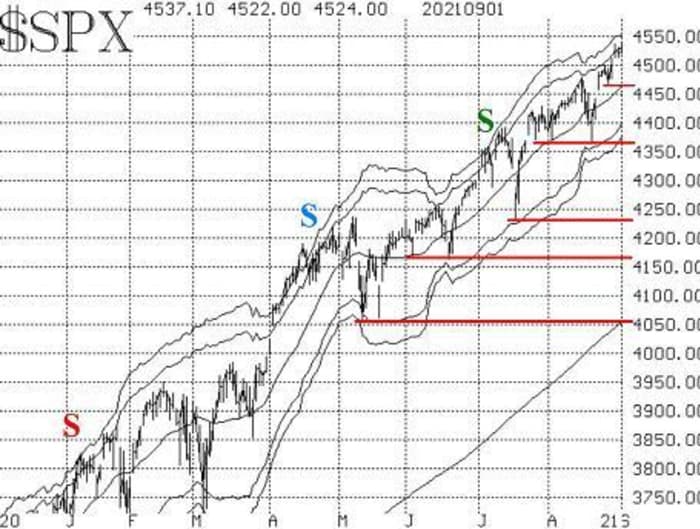

The most recent SPX support level, at 4370, was triply tested and it is strong. But SPX has advanced so much that 4370 is beginning to disappear in the rearview mirror. As for a higher support level, there is tentative support at last week’s lows, near 4470, but it has not been retested.

Lawrence McMillan

There is technically a remaining McMillan Volatility Band (MVB) sell signal from early July, but it has had little effect. It would be stopped out if SPX were to close above the +4σ “modified Bollinger Band” (mBB) which is currently at about 4550.

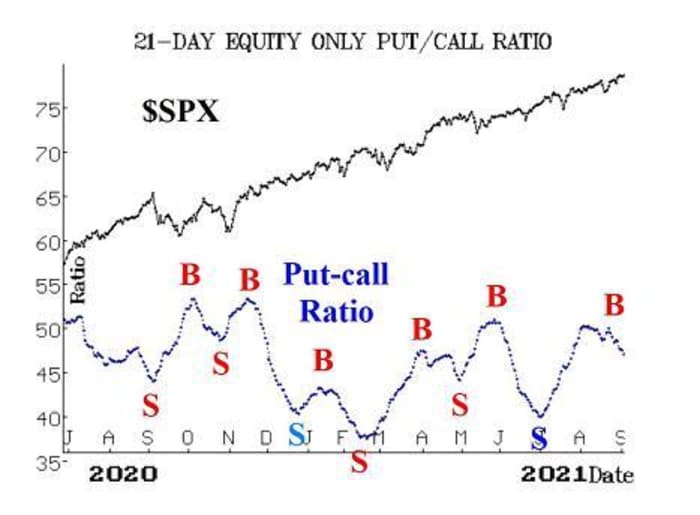

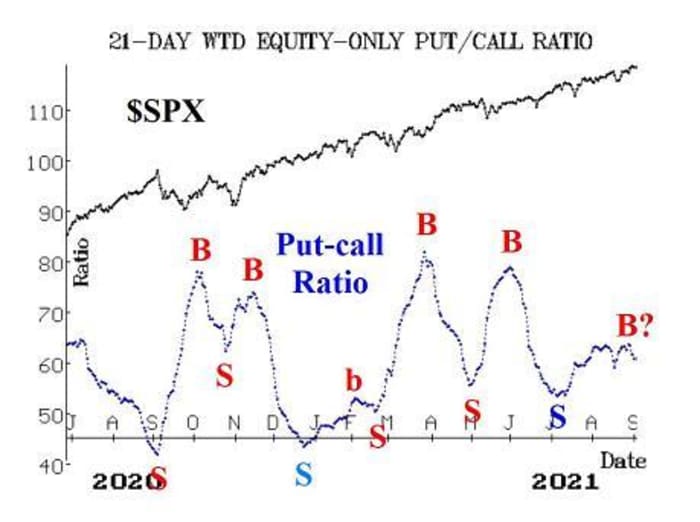

Equity-only put-call ratios have rolled back over and are heading lower. That is bullish for stocks, since a local maximum on the equity-only put-call ratio is a buy signal for the stock market.

The process has been a slow-moving one, though, because of what had been negative internals in the market. That is, a majority of stocks were declining, and traders were buying puts on those – forcing the ratios lower, despite new S&P highs. Now, the situation is resolving itself somewhat, as call buyers of equities have returned, and the ratios are declining. This is some evidence of an improvement in the internals in the overall stock market.

For the record, the computer analysis programs have still not confirmed the buy signal in the weighted ratio – hence, the question mark on that chart.

Lawrence McMillan

Lawrence McMillan

…

Read More: Opinion: Stock-market ‘internals’ are improving, so stay bullish on