Why the stock-market ‘wild card’ isn’t Evergrande, it’s Washington

The potential for another white-knuckle flirtation with default by the U.S. government via a debt-ceiling showdown is helping to raise “policy uncertainty,” analysts noted Wednesday.

The good news is that rising uncertainty has traditionally been a buying opportunity, according to a top Wall Street technician.

“We are believers that this will prove a buyable correction within an uptrend, but we don’t see the wild card being China, rather we see it as Washington,” wrote Jeff deGraaf, founder of Renaissance Macro Research, in a note.

Stocks were gaining ground Wednesday, with the S&P 500

SPX,

up 1% and the Dow Jones Industrial Average

DJIA,

rising 382 points, or 1.1%, ahead of a Federal Reserve policy decision due at 2 p.m. Eastern. Stocks were attempting to shake a so-far modest retreat that’s seen the S&P 500

SPX,

pull back 4% from its record close on Sept. 2.

Renaissance Macro Research

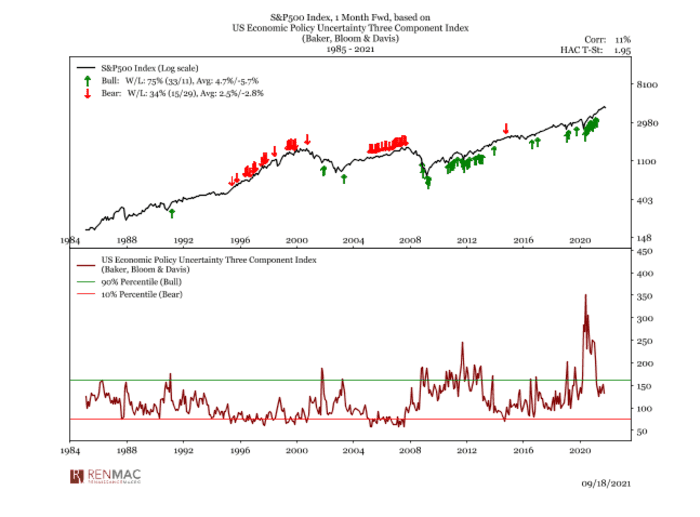

DeGraaf highlighted the chart above, tracking the U.S. Economic Policy Uncertainty Index, devised by economists Scott Baker of Northwestern University, Nick Bloom of Stanford University and Steven Davis of the University of Chicago. It draws on search results from 10 large U.S. newspapers, reports by the Congressional Budget Office that compile tax code provisions due to expire over the next 10 years, and the Philadelphia Fed’s survey of professional forecasters.

While policy uncertainty “has started to migrate into the markets, politicians

will often take things to the edge to see who blinks and gain the upper hand,” he wrote.

While worries over a potential government shutdown in October and the debt ceiling are front and center, uncertainty is also on the rise over President Joe Biden’s agenda, including his infrastructure and social welfare spending proposals.

Renaissance Macro Research sees Republicans in Congress holding the stronger cards, which may allow them to force the issue, deGraaf said, noting that the index hasn’t yet jumped into the top decile (see bottom part of chart), which is typically a bullish signal when it comes to forward returns for the S&P 500 index.

“If your hands are strong enough to hold on, there are plenty of green lights to get the wheels turning, but don’t be surprised to see more planted leaks and adverse headlines before it’s resolved,” he said.

Outside the Box: Evergrande crisis and the U.S. debt-ceiling showdown could give stock investors a buying opportunity

The Democratic-controlled House late Tuesday approved…

Read More: Why the stock-market ‘wild card’ isn’t Evergrande, it’s Washington