Top investors split on direction of ‘tempestuous’ China’s markets

China’s crackdown on foreign investors and domestic property speculation has prompted many international investors to head for the exits. Ray Dalio is not among them.

Instead, the founder of the $140bn US hedge fund Bridgewater Associates and one of the most prominent foreign investors in the country, said he has spoken directly to officials from the Chinese Communist party in the past week, and been encouraged by what he heard.

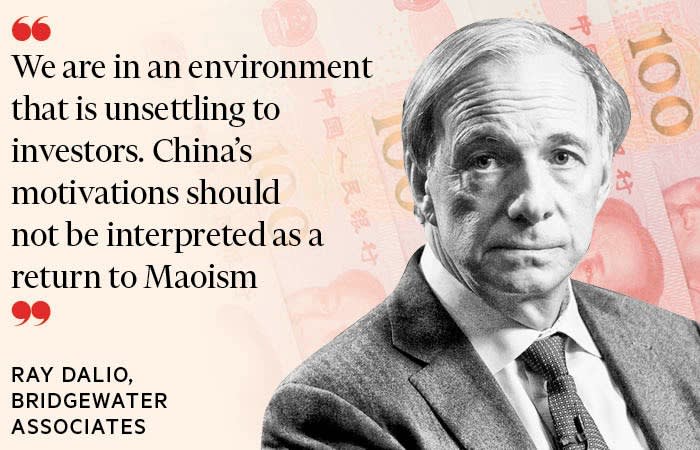

“At this stage I’m assured that this doesn’t mean foreigners and foreign investors are not welcome,” said the 72-year-old, who first visited China 37 years ago. “We are in an environment that is unsettling to investors”, conceded Dalio. But “China’s motivations should not be interpreted as a return to Maoism”, he said in an interview with the Financial Times.

Beijing’s regulatory blows, targeting sectors from video games to education, have wiped more than $1tn of market value from Chinese equities since their recent peak in mid-February.

Goldman Sachs estimates that a further $3.2tn of market capitalisation could be exposed to further regulatory uncertainty — roughly a sixth of the market cap of all Chinese listed companies.

But Dalio says Beijing is seeking the “common prosperity” set out in President Xi Jinping’s 14th five-year plan in March. It wants to correct a period when capitalism raised living standards but also created a “large wealth gap” and “too much debt”, he said.

This week, investors in an offshore bond issued by property developer Evergrande have felt the sharp end of Beijing’s interventions. By Friday afternoon, they had still yet to receive a high-stakes interest payment that had fallen due the previous day.

The world’s most indebted property group has come under pressure as authorities have cracked down on excessive debt in the sector. It has a 30-day grace period before any failure to pay officially results in a default. A missed payment would kick off the biggest restructuring in China’s financial history, in a sector that accounts for nearly a third of the country’s economy.

Renowned short seller Jim Chanos warned this week that Evergrande’s crisis could be “far worse” for investors in China than a “Lehman-type” systemic crisis because it points to the end of the country’s property-driven growth model. China would need to find “new growth drivers”, he added, “or downshift somewhat semi-permanently into a lower level of growth”.

Others were more sanguine, maintaining that government intervention in China is nothing new and does not derail longer-term structural trends, such as an emerging middle class of consumers.

“It would be extreme and wrong-headed to regard China as uninvestable,” said Fred Hu, chair and chief executive of Primavera Capital Group, and former head of China at Goldman Sachs. “In the same way, no one could credibly claim Europe is…

Read More: Top investors split on direction of ‘tempestuous’ China’s markets