Feeding frenzy hits new peaks as companies rush to raise funds

Capital markets have never been so hot.

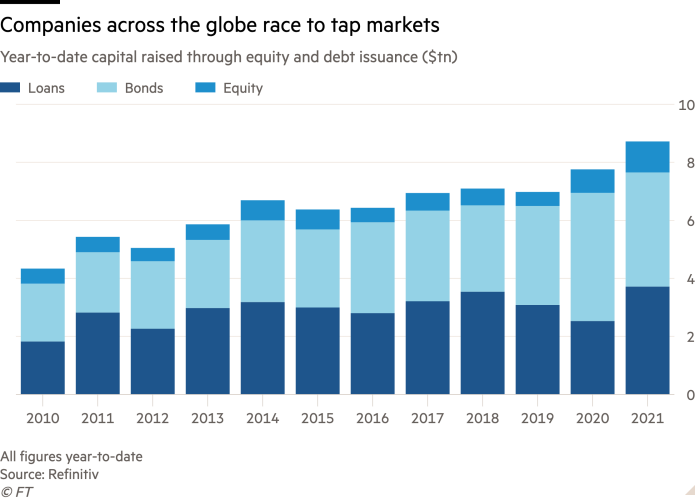

Companies across the globe have tapped investors for trillions of dollars in debt and equity this year, taking advantage of rallying stock markets and rushing to exploit the easiest borrowing conditions in decades before the Federal Reserve and other major central banks start to withdraw their support.

The feeding frenzy, including more than $1tn worth of share sales and nearly $4tn of bond issuance, involves the biggest names in the corporate world, including Apple, Walmart, Baidu and Volkswagen. And even though bankers are racing to ink loans and finalise initial public offerings, the backlog of deals still to be done remains daunting.

“People are flat out right now, whether that be equity capital markets bankers, M&A bankers, lawyers — the City is definitely full with transactions,” said Duncan Smith, head of European equity capital markets at RBC. Smith compared the intensity of work on initial public offerings and secondary share sales to the dotcom boom and the years before the financial crisis.

Some $8.7tn has been raised across equity sales, bond offerings and loan deals — including loans syndicated and held by banks — at a record pace, according to the data provider Refinitiv. The ferocious pace has exhausted the fund managers who must decide if they are willing to invest, but it has not yet sated their demand, even though markets wobbled at the end of September.

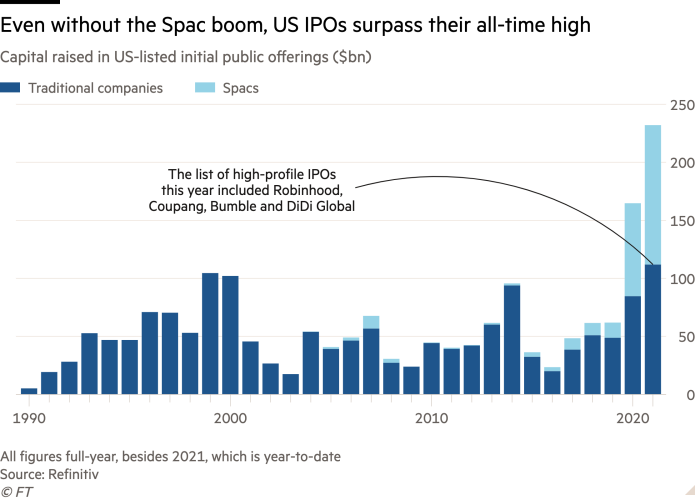

In the US, traditional IPO volumes for the first time eclipsed the peak set in 1999 before the dotcom bust as companies like brokerage Robinhood have come to market. Banks including Citi, Bank of America and Goldman Sachs, which are poised to take in record investment banking fees this year, are adding or moving staff to their underwriting and syndication teams so they do not lose work to rivals.

Global equity issuance is now within striking distance of the full-year record set last year, boosted by $504bn of secondary share sales by publicly listed groups like China Telecom and UK insurer Prudential. And with the listings of companies like FWD Group, the insurer owned by Hong Kong billionaire Richard Li, and electric-vehicle maker Rivian expected before the end of the year, dealmakers say that the tally could soon eclipse that record.

The figures are striking even when excluding the deluge of shell companies known as Spacs that listed early in the year — a trend that captivated Wall Street as hundreds of organisations with no real businesses went public with a view to buying other businesses and launching them on to stock markets.

Nearly 500 special purpose acquisition companies have raised $128bn this year, including $15.7bn in the third quarter. The number of Spacs going public has dropped considerably from the start of 2021, and stabilised in recent months, particularly as earlier listed shell companies found private companies with which to merge.

“In the first quarter it was an enormous portion of the IPO market,…

Read More: Feeding frenzy hits new peaks as companies rush to raise funds