Buy the dip has failed. Here’s what investors need to do next, says

A risk-off Monday is brewing to start the week, with stock futures lower and the 10-year yield edging back toward 1.5%.

And we’ll get jobs numbers at the end of the week that are expected to be strong, and the Federal Reserve will definitely be watching. So a jittery market is understandable.

Our call of the day comes from Mike Wilson, chief investment officer at Morgan Stanley, who offers a bucket of reasons to stay defensive on this market.

“Large-cap quality leadership since March is signaling what we believe is about to happen — decelerating growth and tightening financial conditions. The question for many investors now is whether the price action has already discounted these fundamental outcomes. The short answer, in our view, is no,” said Wilson, in a Sunday note to clients.

Wilson’s list of reasons includes China growth problems that will likely stem from troubled property giant Evergrande (more on that below) — not completely priced into it. And then there’s the surprising speed at which the Fed expects to be done tapering — by mid next year — a “clearly hawkish shift.” The subsequent market fallout — bonds and yields up, equities down — is telling, he said.

“In short, higher real rates should mean lower equity prices. Secondarily, they may also mean value over growth even as the overall equity market goes lower. This makes for a doubly difficult investment environment given how most investors are positioned,” he said.

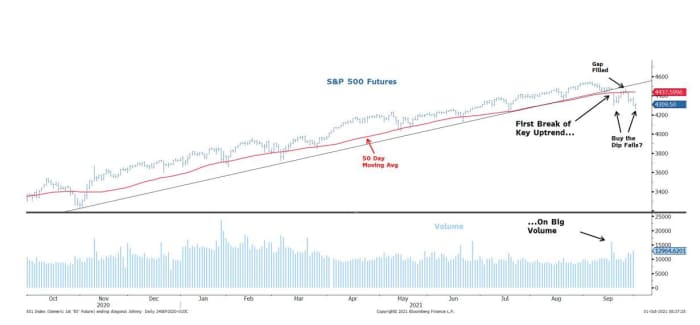

One last defensive signal came from a surprising challenge recently to that “buy-the-dip” strategy — “the most powerful offset to a material correction in the S&P 500 this year,” said Wilson.

“After the Evergrande dip and rally, stocks have probed lower and taken out the prior lows, making this the first time that buying the dip hasn’t worked, simultaneously violating important technical support,” he said, providing the following chart.

Morgan Stanley/Bloomberg

As for what to do with all this, Wilson said the team has favored a “barbell” of defensive sectors — healthcare and staples that should hold up as earnings revisions start to see pressure from decelerating growth and rising costs. Add financials, which benefit from a rising interest-rate environment.

Consumer discretionary stocks, meanwhile, are “especially vulnerable to a payback in demand from last year’s overconsumption.” In that realm, Wilson likes services over goods for pent-up demand remaining, while some tech stocks are at risk from a work-from-home dynamic that’s fading. Semiconductors are the…

Read More: Buy the dip has failed. Here’s what investors need to do next, says