Opinion: Why the stock market is signaling ‘melt up’ through the end

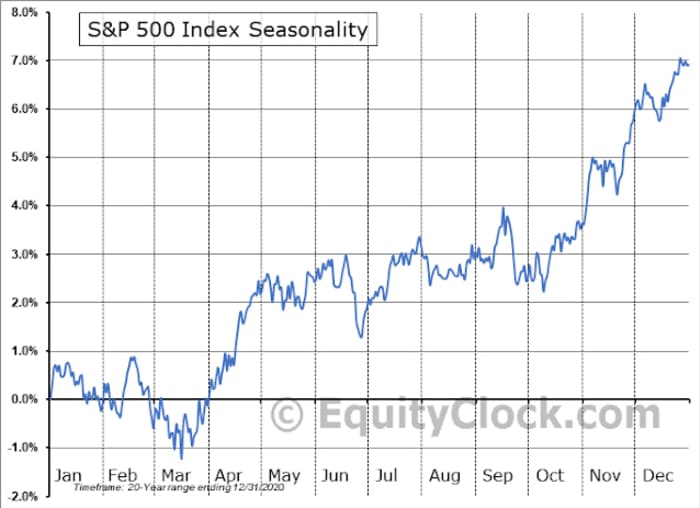

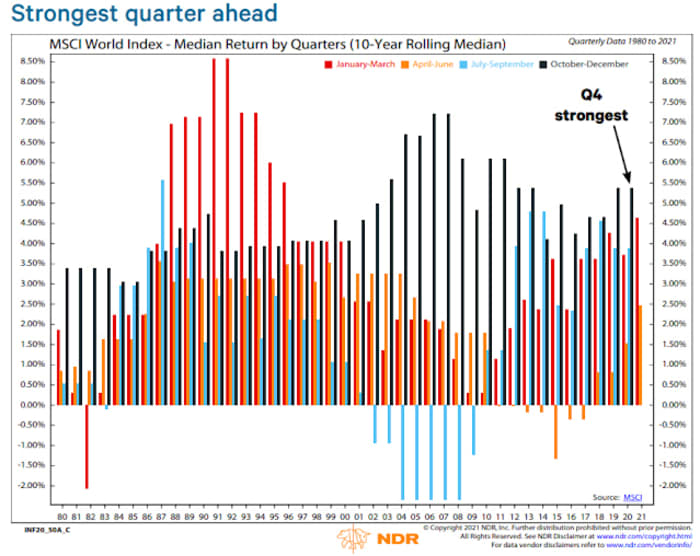

What are the odds of a melt-up for U.S. stocks for rest of 2021? If history is any guide, stocks can be expected to bottom in early October and begin a period of seasonal strength into year-end.

Risk appetite indicators have been steadily improving, but haven’t risen sufficiently to flash a buy signal just yet. These readings are consistent with my fourth-quarter sector review, which also found signs of cyclical and reflation strength, but no broad-based confirmation.

Supportive sentiment

The sentiment backdrop is becoming more supportive of an advance, though readings haven’t fallen to panic extremes. For example, the NAAIM Exposure Index, which measures the sentiment of registered investment advisers, plunged recently but didn’t break the 26-week Bollinger Band. A penetration of the low Bollinger Band has been a strong buy signal in the past.

These conditions lead me to believe that risk/reward in U.S. stocks now is tilted to the upside. The maximum drawdown of the S&P 500

SPX,

from its highs is -5%. It’s conceivable that stocks could pull back, but another 2%-3% of weakness is likely to spark panic levels in many sentiment models. While I am cautiously bullish, I am not ready to go all-in just yet.

Supply chain bottlenecks

Won’t rising energy prices create inflationary pressure and force the Fed to act? Fed Chair Jerome Powell testified that inflationary pressures were expected to be transitory because of supply chain bottlenecks, but allowed that the transitory period may last longer than expected.

The headlines may see rising hysteria over shortages in the coming weeks as Christmas nears and products aren’t available in plentiful supply. In reality, the shortages are attributable to a supply shock owing to rising demand in the face of limited manufacturing and transportation capacity. Central bankers raising interest rates won’t make the semiconductor shortage go away, nor will it expand shipping and trucking capacity.

Although there are many bottlenecks, in particular in transporting…

Read More: Opinion: Why the stock market is signaling ‘melt up’ through the end