What Federal Reserve tapering means for markets

Expectations are running high for the Federal Reserve to lay out its plans next week to begin supplying less monetary aid to markets.

But what happens if the Fed on Wednesday, after its two-day Federal Open Market Committee meeting, actually pulls the trigger and starts reducing its $120 billion monthly pace of bond purchases?

“Obviously, a ton of liquidity already has been poured into the market, and there are parts of fiscal stimulus that haven’t even been distributed yet,” said Tony Bedikian, head of global markets at Citizen Bank, in a phone interview.

With that backdrop, Bedikian said stocks should be supported by a continued risk-on trade into next year, even if the Fed also starts to modestly increase policy interest rates from the current 0% to 0.25% range.

He also anticipates the U.S. economy will keep recovering from the coronavirus pandemic and growing, as the Fed takes a step back, particularly if consumers continue spending and no “scares” emerge on the COVID front — unless high inflation gets in the way.

“We continue to worry about elevated inflation,” Bedikian said. “If it continues to be that way, then the Fed might have to hike more aggressively to help pull back inflation.”

Inflation: gains, pains

Low interest rates are designed to spur lending by banks during times of crisis and borrowing by companies and individuals.

Adding large-scale bond purchases by central banks into the mix provides an anchor, sinking bond yields and causing demand for stocks and other financial assets to rise.

“The whole point is a shock to the system,” said Stephen Dover, Franklin Templeton’s chief market strategist and head of its investment institute. “Right now, the reserve banks are continuing to buy more instruments,” just perhaps less of them down the road. “It doesn’t mean in the short-term they reduce what they already own.”

That’s also why things have gotten contentious. Billionaire hedge-fund manager Bill Ackman on Friday joined a growing chorus of market heavyweights urging the Fed to stand down.

See: Bill Ackman says ‘Fed should taper immediately and begin raising rates as soon as possible

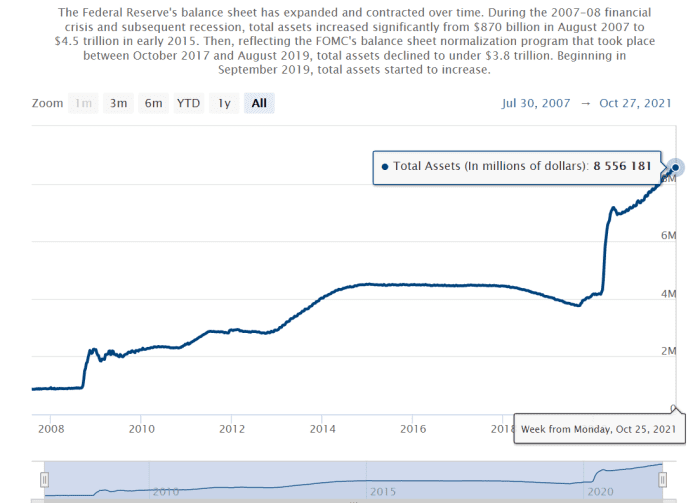

It’s now been 19 months of Fed bond-buying, and its balance sheet roughly has doubled to a record $8.6 trillion. This chart shows how difficult it has been for the Fed to reduce its footprint in markets — even modestly — since it first started buying bonds after the 2008 global financial crisis.

Fed’s balance sheet was last under $1 trillion in 2008

Federal Reserve Board

Without extraordinary monetary…