The ‘Tesla-financial complex’: how carmaker gained influence over the

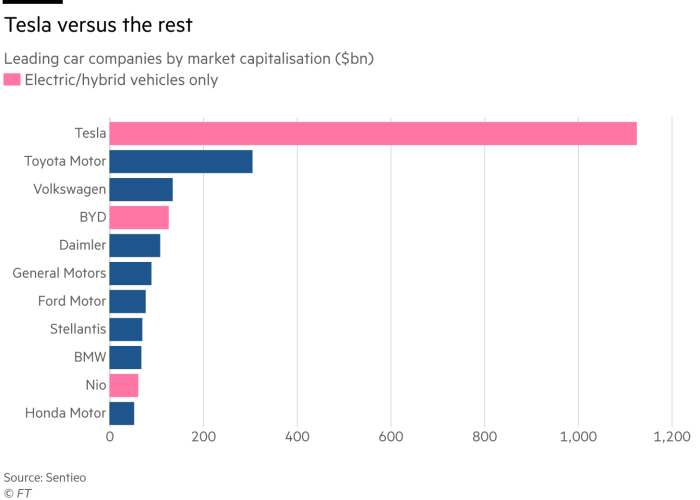

The rally in Tesla’s shares has lifted the overall stock market value of Elon Musk’s electric carmaker to over $1.1tn, making it one of the most valuable companies in the world. This year alone it has added almost $475bn in market capitalisation, equal to a Procter & Gamble, a JPMorgan — or two McDonald’s.

However, the real importance and wider footprint of what might be called the “Tesla-financial complex” far outstrips the company’s market capitalisation. This is thanks to a vast, tangled web of dependent investment vehicles, corporate emulators and an enormous associated derivatives market of unparalleled breadth, depth and hyperactivity.

Combined, these factors mean Tesla’s influence over the ebb and flow of the stock market is far greater than even its size would imply. It may even be historically unrivalled in its wider impact, some analysts say.

“We don’t really have the language to describe Tesla any more,” says Michael Green, chief strategist at Simplify Asset Management. “It’s like explaining to a person in a two-dimensional world the concept of ‘up’.”

The Tesla-financial complex is a phenomenon that many investors — whether passive index funds, traditional mutual funds, hedge funds or ordinary retail investors — have no choice but to contend with, given the idiosyncratic force it now exerts over the stock market.

“It stands out like a sore thumb,” says Dean Curnutt, the chief executive of Macro Risk Advisors. “It’s something you’ve got to pay a lot of attention to.”

One of Tesla’s oddest quirks is the fuel that has helped power its rocketing stock market value. Although its stock is wildly popular with many ordinary retail investors, the swelling size and hyperactivity of Tesla “options” — popular derivatives contracts that allow investors to bet both on and against a stock and magnify any gains and losses — has also flabbergasted many market veterans.

The nominal trading value of Tesla options has averaged $241bn a day in recent weeks, according to Goldman Sachs. That compares with $138bn a day for Amazon, the second most active single-stock option market, and $112bn a day for the rest of the S&P 500 index combined. This makes Tesla’s stock more prone to whipsaw movements, because of the “leverage” inherent in using options to trade.

“The Tesla options volume has always been outsized, but it is now huge,” says Michael Golding, the US head of Optiver, a trading firm active in the options market. “Tesla almost represents a generation. It’s come to represent innovation, at a time when option trading has taken off.”

The Tesla options market — more than 60 times as active as the entire FTSE 100 options market, and almost seven times greater than Euro Stoxx 50 options — has helped push US option trading volumes above actual stock trading…

Read More: The ‘Tesla-financial complex’: how carmaker gained influence over the