BDC Market Weekly Review: A 2021 Two-Peat Will Be That Much Harder

shapecharge/iStock via Getty Images

This article was first released to Systematic Income subscribers and free trials on Jan. 8.

Welcome to another installment of our BDC Market Weekly Review where we discuss market activity in the Business Development Company sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the first week of January.

Be sure to check out our other Weeklies – covering the CEF as well as the preferreds/baby bond markets for perspectives across the broader income space. Also, have a look at our primer of the BDC sector with a focus on how it compares to credit CEFs.

Market Action

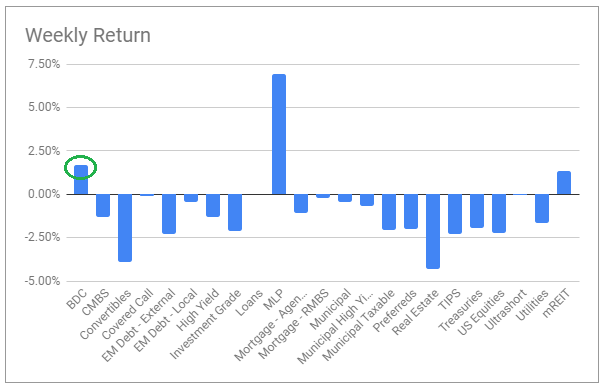

The BDC sector continued to do well in January after a strong 2021 with a ~1% total return in the first week.

The key theme so far of 2022 is a mini tantrum happening in Treasuries where yields have risen each day of the first week with the 10-year yield now standing 0.41% higher than its December low.

With both stocks and Treasuries lower, it is no surprise that most income sectors are lower as well. What stands out in this picture is the strength in BDCs as highlighted in the chart below.

Systematic Income

It is not obvious why BDCs should deliver positive returns in a market where both stocks and Treasuries are lower. Perhaps one reasonable explanation is that current market weakness comes from a more hawkish turn by the Fed revealed in the recently released minutes of the mid-December meeting. In this meeting, governors indicated a possibility of more policy hikes as well as a potential selling of Fed holdings over and above an earlier acceleration in the taper of bond purchases.

The key channel of transmission of this more hawkish policy over 2022 will be in higher policy rates. And since BDCs hold primarily floating-rate instruments with a 92% average allocation (96% in median terms) investors are taking the view that higher short-term rates will lead to higher net investment income in the sector – a topic we explored earlier.

This is why it is useful that BDCs explicitly declare the sensitivity of their net investment income to higher short-term rates. There are three key takeaways for investors. First, the sensitivity of BDC income, in aggregate, to higher short-term rates is not linear but convex. In other words, it first moves lower (up to about a Libor level of 1.1%) before moving higher.

A NII profile of the Goldman Sachs BDC (GSBD) is quite typical of the sector. It shows that NII (y-axis) moves lower for a rise in Libor (x-axis) of up to 1% and then moves significantly higher for a rise in Libor beyond 1%.

Systematic Income BDC Tool

Second, there is great variation in NII sensitivity in the sector. For a 1% rise in Libor, the NII…

Read More: BDC Market Weekly Review: A 2021 Two-Peat Will Be That Much Harder