Preferreds Market Weekly Review: OTC Dividend Suspension

da-kuk/E+ via Getty Images

This article was first released to Systematic Income subscribers and free trials on Jan. 8.

Welcome to another installment of our Preferreds Market Weekly Review where we discuss preferreds and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the first week of January.

Be sure to check out our other weekly updates covering the BDC as well as the CEF markets for perspectives across the broader income space.

Market Overview

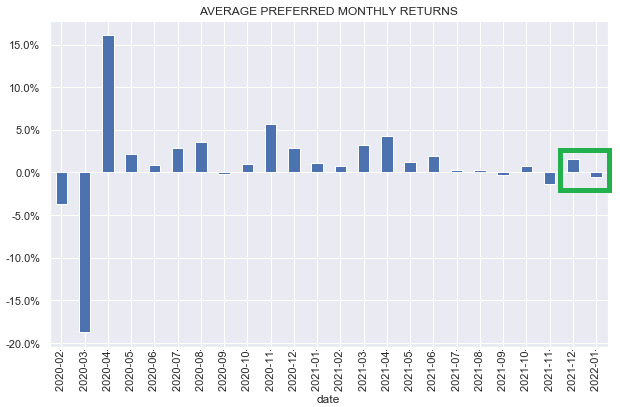

The preferreds market continues its “fat and flat” see-saw price action pattern. While the December Santa Rally delivered the strongest monthly return since June of last year, January has been disappointing so far.

Systematic Income

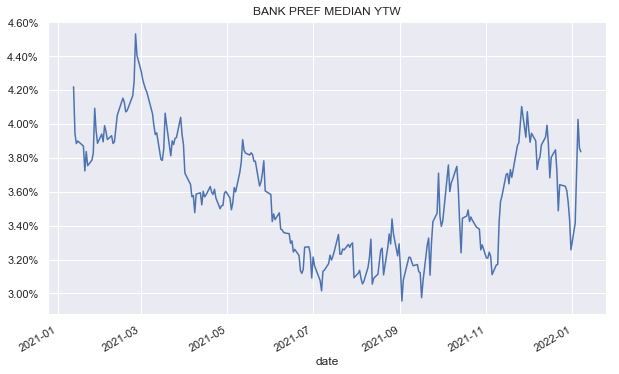

The biggest theme of the year so far has been the relentless rise in Treasury yields. Each trading day of the year brought higher longer-term yields and the 10Y yield now stands at 1.76% or 0.41% higher off its December low.

The knock-on effect of this rise in Treasury yields has been the rise in higher-quality preferred yields. The banks sector median yield-to-worst, for example, has risen closer to 4%. This makes taking low-coupon / duration exposure a bit more palatable in the current environment.

Systematic Income

The risk of higher rates is one that continues to hang over investors. However, higher rates is far from the only risk. A number of macro indicators are already suggesting we are moving into the mid-cycle period where the economy is more vulnerable to falling back into a recession. Longer-duration higher-quality preferreds provide an attractive allocation for this scenario as they can be supported by the typical pattern of lower rates in recessionary environments and their higher quality (i.e. investment-grade ratings) means they can weather a macro downturn.

A few securities worth highlighting in the space are the investment-grade and crossover rated preferreds such as the Capital One 4.375% Series L (COF.PL), JPM 4.2% Series MM at a 4.4% yield, (JPM.PM) at a 4.26% yield and Wells-Fargo 7.5% Series L (WFC.PL) at a 5.1% yield.

Market Themes

There was a quick exchange on Amtrust preferreds on the service chat this week. These preferreds were delisted by the issuer when the company was taken private with the comment that it was too burdensome to maintain the required regulatory reporting. The company also recently accepted a $10m civil penalty from the SEC relating to its loss reserve estimates. The preferreds are non-cumulative and yield around 10%.

Investors are basically worried that the company will suspend dividends and leave them in the lurch. Though this seems unlikely for a financial issuer, the preferreds are already trading around 25% below liquidation…

Read More: Preferreds Market Weekly Review: OTC Dividend Suspension