The Federal Reserve needs to ‘shock and awe’ the market with one big

Billionaire hedge-fund manager Bill Ackman said the Federal Reserve needs to deliver old-fashioned “shock and awe” to financial markets by delivering a much larger onetime increase to benchmark interest rates to combat inflation.

“The @federalreserve could work to restore its credibility with an initial 50 bps surprise move to shock and awe the market, which would demonstrate its resolve on inflation. The Fed is losing the inflation,” wrote Ackman in a series of tweets on Saturday.

Ackman said the U.S. central bank has lost some credibility on Wall Street, which may be hurting its ability to affect inflation expectations, which is seen by some as a significant drag on sentiment.

“The unresolved elephant in the room is the loss of the Fed’s perceived credibility as an inflation fighter and whether 3 to 4 would therefore be enough,” he wrote.

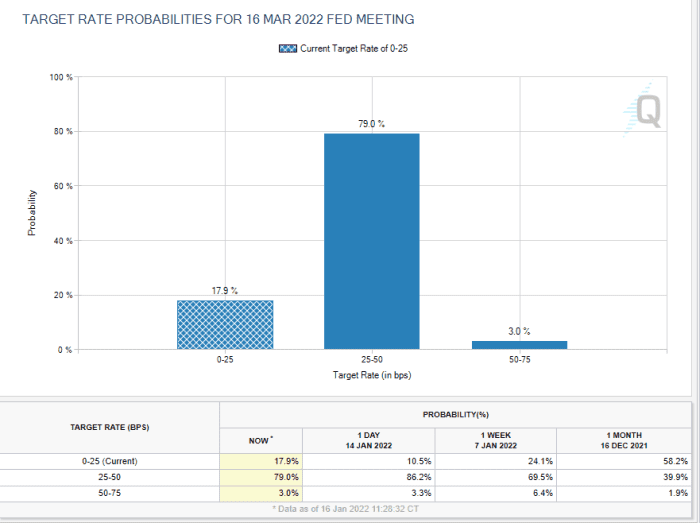

Markets are widely expecting the Federal Reserve to deliver a hike of 25 basis points at its March meeting. According to data compiled by the CME Group Inc.

CME,

the odds point to a 79% chance of such a hike, with just a 3% chance of an increase of 50 basis points to the federal funds rates, which currently stand at a range between 0% and 0.25%.

CME Group

The Fed has penciled in a plan to raise its benchmark interest rate to 2.1% by the end of 2023. Former New York Fed President William Dudley and others think the central bank will likely have to push its benchmark rate up closer to 4% to reverse easy monetary policy largely kept in place due to the COVID-19 pandemic.

Fed Chairman Jerome Powell told the Senate Banking Committee earlier in January that a surge in inflation, rising to highs not seen in about 40 years, came from the imbalance of supply and demand. While the Fed can cool demand, it will get some help as supply constraints ease, he said.

Read:Forget Rate Hikes. How the Fed Handles Its $9 Trillion in Assets Is What Really Matters and Fed Weighs Proposals for Eventual Reduction in Bond Holdings

Some market economists and strategists, however, have made the case that Fed policy makers have made an error in not tackling inflation sooner and referring to it as transitory, with Deutsche Bank researchers, describing the U.S. central bank as “way behind the curve” since early last year in tightening policy, which is now forcing it to move faster and sooner than had been expected.

Read More: The Federal Reserve needs to ‘shock and awe’ the market with one big