Forget Stock Market Crash, Bond Market May Collapse: Sell TLT

MicroStockHub/iStock via Getty Images

I have been growing increasingly bearish and pessimistic about the outlook for U.S. interest rates and the bond market generally since the middle of 2020. The extend and pretend exercise of low interest rates and record rates of money printing can only continue so long, before something breaks. The Federal Reserve’s balance sheet is approaching $9 trillion in bonds, a source of direct interference in our free-market capitalistic system, outrunning any previous central bank shenanigan in human history. Now with inflation beginning to skyrocket as CPI YoY passed +7% in December, either interest rates will rise markedly in 2022 to rebalance the economy, or we risk even higher moves into the annualized 10% or greater CPI range by the end of the year (only rivaled by Civil War inflation), with a massive destructive interest rate spike into the stratosphere soon thereafter.

Really, the last remaining economic scenario to prevent a major rise in long-term interest rates, and properly match escalating inflation, is a stock market crash ASAP followed by a disinflationary recession to properly rebalance consumer supply/demand. Yippie! However, since the stock market refuses to decline for more than a day or two, a monster decline in bond market pricing, including products like the iShares 20+ Year Treasury Bond ETF (TLT), may lie dead ahead.

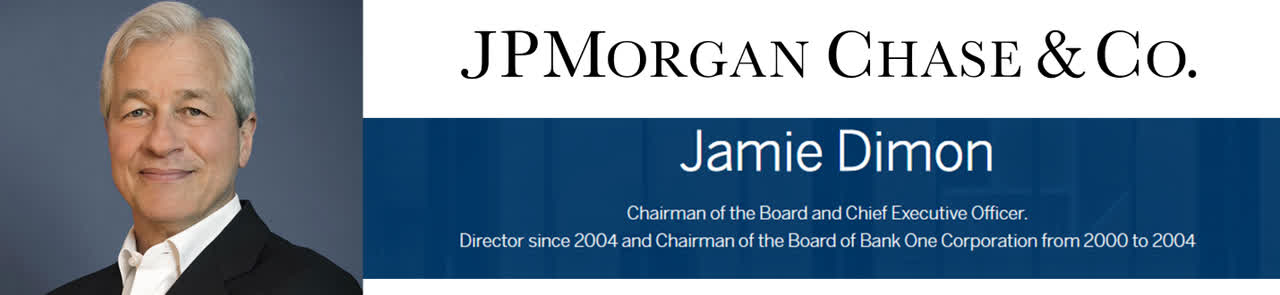

Don’t take my word for it. Financial managers and experts, left and right are coming to the same conclusion in late 2021 and early 2022. None other than the leader of the largest bank in the U.S., CEO Jamie Dimon of JPMorgan Chase (JPM) explained on Friday, during the company’s Q4 earnings release, an amazing and unprecedented number of 6 or 7 bank lending rate hikes would be necessary in 2022 to hold the economy together.

JPMorgan Chase Website

Specifically, Mr. Dimon, who many observers and investors including myself consider the most influential banker outside the central bank circle said,

… So, my view is a pretty good chance there’ll be more than 4. It could be 6 or 7. I mean, I grew up in a world where you — Paul Volcker raised interest 200 basis points on a Saturday night. And this whole notion that somehow it’s going to be sweet and gentle and no one is ever going to be surprised. I think it’s a mistake …

And the other fact is, it may very well be possible that they’re loan rates — and I’m a little surprised how low they stay. But the loan rates may react more to the actual QE and then QT. And so, at one point, the Fed is going to be letting run off $100 billion or whatever number a month they’re going to come up with. And then you may see loan rates react a little bit to that. And particularly, I just said about growth and demand for capital and stuff like that, that also tends to drive 10-year bond rates and all that …

The fear is the U.S. dollar’s value in foreign exchange markets will not hold up with the Fed sticking its head…

Read More: Forget Stock Market Crash, Bond Market May Collapse: Sell TLT