Alibaba Stock: A New Hope (NYSE:BABA)

Lyubov Smirnova/iStock via Getty Images

Intro

The market price of a share always reflects the momentary attitude of investors to the future potential of the company, adjusted for risks. As part of this view of the nature of the stock market, the key reason for the more than 60% drop in Alibaba’s (BABA) capitalization last year was the sharply increased risks.

At the same time, if we are dealing with risks, we should be extremely careful. Because risks are always overestimated by human psychology. And yet, today I want to carefully point out one positive thing in the Alibaba story, which directly points to the reduction of risks.

Migration of investors

According to Bloomberg, the relative volume of Alibaba shares traded in Hong Kong increased from 28.9% in January 2021 to 53.4% in January this year. Moreover, Alibaba is the leader in terms of the growth rate of this indicator:

It is clear that the migration of investors to the Hong Kong stock market is a consequence of regulatory pressure on Chinese companies whose shares are traded in the US. In addition, DiDi’s (DIDI) intention to delist from the US indirectly convinced investors that a similar situation could happen to any Chinese company.

In my opinion, this process has two sides. Firstly, in terms of liquidity, the Hong Kong stock market is not comparable to the US stock market. Therefore, one should not think that abandoning ADRs is a painless option for investors.

But secondly, as the number of Alibaba shares traded in Hong Kong grows, ADR holders are becoming more comfortable with the risk of Alibaba being delisted from the US. Investors understand that in the worst case, they can keep part of their investment by selling Alibaba shares on the Hong Kong stock market. This reduces the overall risk of owning the company’s shares.

Good start to the year

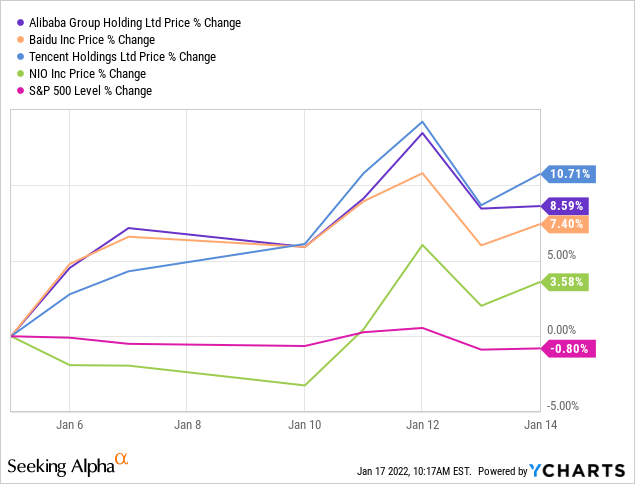

It is interesting to note that the above is already beginning to be reflected in the market. So, since the beginning of the year, shares of Chinese technology companies traded on US stock exchanges have shown much better dynamics than the US stock market:

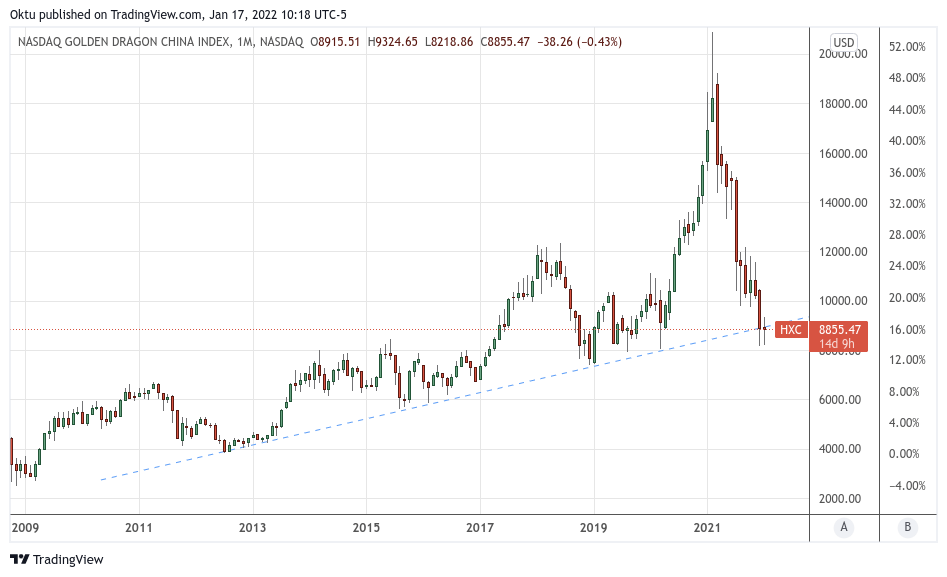

It is especially important that the positive dynamics concerns the entire segment of Chinese companies, and not individual ones. So, since January 5, the Nasdaq Golden Dragon China Index, which tracks 93 Chinese companies listed in the US, has risen nearly 7%. Over the same period, the Nasdaq index fell nearly 5%:

In my opinion, this means that now there is a reassessment of the risks of investing in Chinese companies. Obviously, these risks are reduced.

If we have already touched on the Nasdaq Golden Dragon China Index, there is one more detail to pay attention to. Over the past ten years, this index has been moving along an upward support level:

At the end of December, the price of the index fell below this level. But already in January, the index rose above the support level. It is very early to make statements about reaching the…

Read More: Alibaba Stock: A New Hope (NYSE:BABA)