Major Stock Averages Down, Market Crash Will Probably Get Worse

Gearstd/iStock via Getty Images

In late November, I wrote about the coming “drop” around the top in the tech market. Here we are, several weeks later, and declines have been epic in some names. From peak to trough, Nvidia (NVDA) was down by 25%, Advanced Micro Devices (AMD) 24%, Tesla (TSLA) 28%, Meta (FB) 17%, Amazon (AMZN) 16%, and Microsoft (MSFT) 14%. These are only several examples, but many top tech stocks and other growth names are down by similar margins, worse in many cases. While most major stock averages are still down by fewer than 10%, declines could continue and accelerate moving forward.

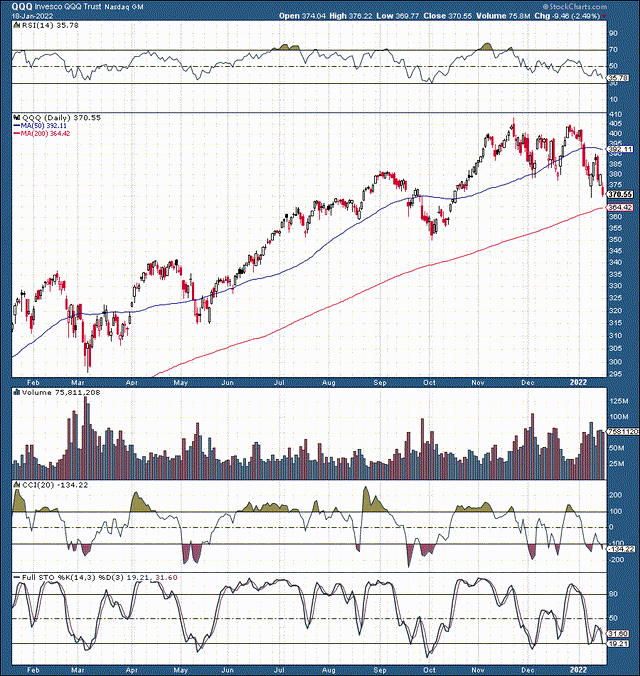

Invesco QQQ Trust/Nasdaq 100 ETF (QQQ) 1-Year Chart

After QQQ’s blow-off top in late November, things have gone downhill. We witnessed some sideways price action for a couple of months, but then the tech-heavy ETF broke below $380 support and is now on the verge of breaking down below the critical support level at $370 (10% correction mark) as well. If this breakdown occurs, it could send prices down to $350 support next, possibly lower after that.

The Problem?

The Fed taper has started, earnings have been disappointing to start the year, momentum and technical conditions continue to weaken, and possibly the most significant factor is that valuations are still very high. There are other elements responsible for plaguing the stock market lately, but I will stick to the core reasons in this analysis.

Valuations are Still a Big Problem

In my late-November article, I spoke about stocks like Nvidia and other high-flyers trading at extremely high multiples.

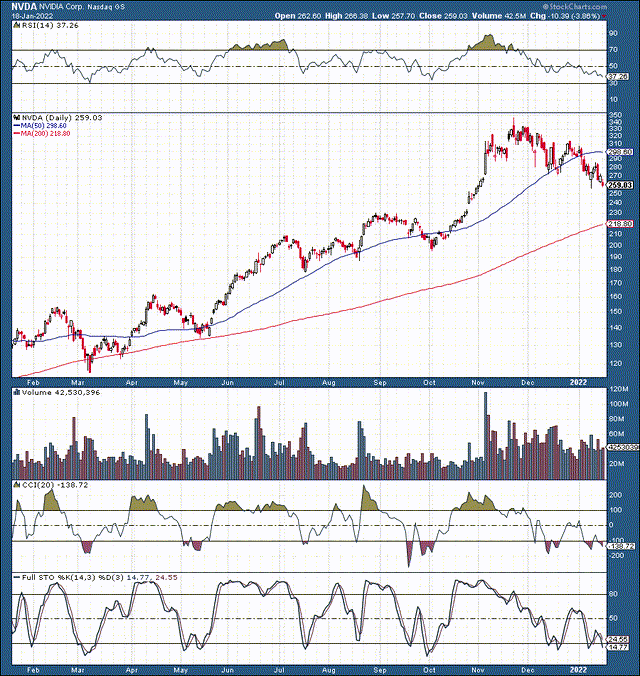

Nvidia 1-Year Chart

Nvidia’s stock has declined by 25% since its blow-off top. However, its shares are still expensive. Consensus EPS estimates illustrate that Nvidia should earn about $5 this year, putting its forward P/E ratio at a frothy 52. Moreover, the company should deliver approximately $31 billion in revenues in 2022, putting its price to sales ratio at a sky-high 22. Nvidia will likely see relatively modest revenue and EPS growth (15-20%) starting in H2 2022. Therefore, this stock still looks overvalued here, even after a 25% decline.

Nvidia is Not Alone

The problem is that Nvidia is not alone. Back in my cautious mid-November macro article, I picked on Nvidia and other “usual suspects” for being overvalued, but I also called out Apple (AAPL) and Microsoft shares. Apple and Microsoft are by far the biggest S&P 500/SPX (SP500) components, and the top seven tech-titans account for a whopping 26% of the index’s total weight. While sector rotation has prevented the S&P 500 from experiencing sharp declines, more weakness in the big-tech sector could drag the major average down notably lower as well.

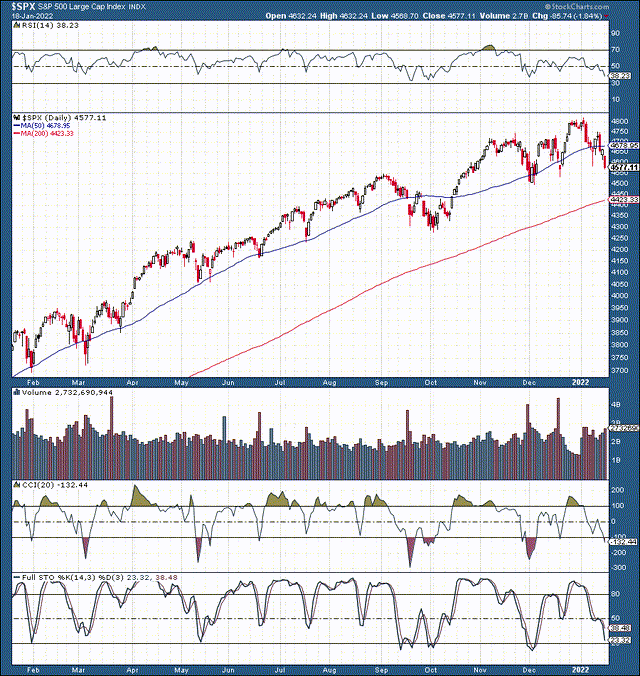

The S&P 500 1-Year Chart

After the tech-top in November, the SPX made a modestly higher high due to sector rotation. However, the tech sector has grown so big that other sectors are unlikely to make up for future tech…

Read More: Major Stock Averages Down, Market Crash Will Probably Get Worse