Nasdaq Composite has logged 65 corrections since 1971, and as it

The Nasdaq Composite Index is in jeopardy of its first close in correction territory since March with a rapid surge in Treasury yields, and expectations for interest-rate increases from the Federal Reserve blamed for the weakness in the once-highflying benchmark.

The technology-heavy index is off to a terrible start, down 7.5% so far in 2022.

In the next several sessions, the Nasdaq Composite

COMP,

needs to avoid closing below 14,451.69, which would represent a 10% decline from its Nov. 19 record peak, meeting the common definition for a correction in an asset price.

Although the Nasdaq Composite appears to be attempting a mini recovery on Wednesday, its momentum—the benchmark closed below its 200-day moving average for the first time since April of 2020 on Tuesday —suggests that a fall into correction, marking its first since March 8, is all but assured unless a remarkable comeback ensues.

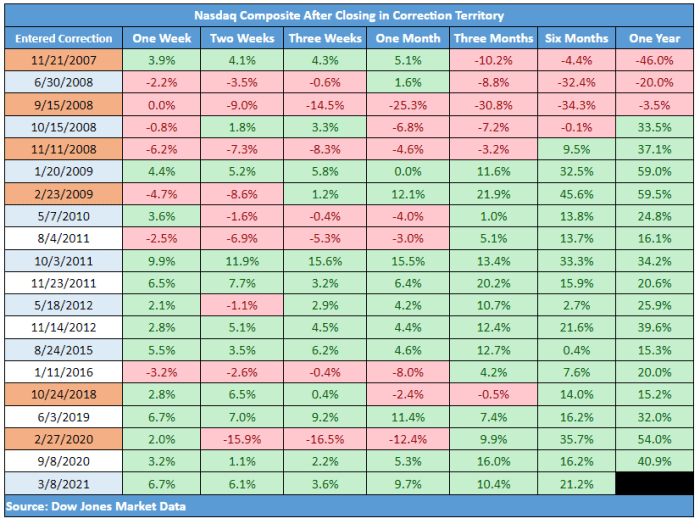

The index has registered a correction, as defined, 65 times since it was first launched in 1971 and of those corrections, 24 of them, or 37%, have resulted in bear markets, or declines of at least 20% from a recent peak.

More recently, corrections have served as buying opportunities, with the sojourn into correction on March 8 resulting in subsequent gains for the one-week, two-week, three week, one-month, periods, going all the way out to six months. A similar uptrend took hold when the Nasdaq Composite slipped into correction territory in early September of 2020.

Dow Jones Market Data

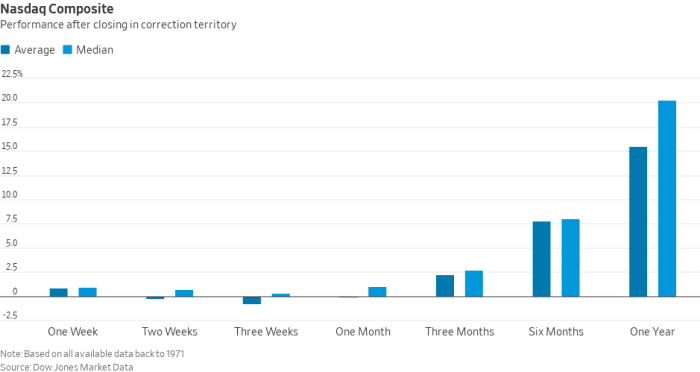

Looking more broadly at the performance of the Nasdaq Composite over the past 65 times it has descended into correction, it has finished positive on average, up 0.8%, in the week after, but returns over that first month are weak, until the benchmark breaks through into the three-month period and beyond, where average gains are 2.2%.

Dow Jones Market Data

U.S. stocks have been falling since the start of the year, with the Dow Jones Industrial Average

DJIA,

and the S&P 500…

Read More: Nasdaq Composite has logged 65 corrections since 1971, and as it