As Equity Market Risks Mount, Institutional Traders Look To Options

ipopba/iStock via Getty Images

Originally Posted On January 10, 2022

By Paul Golden

At A Glance

- Block trades allow institutions with large-scale equity exposure a chance to efficiently lay off risk

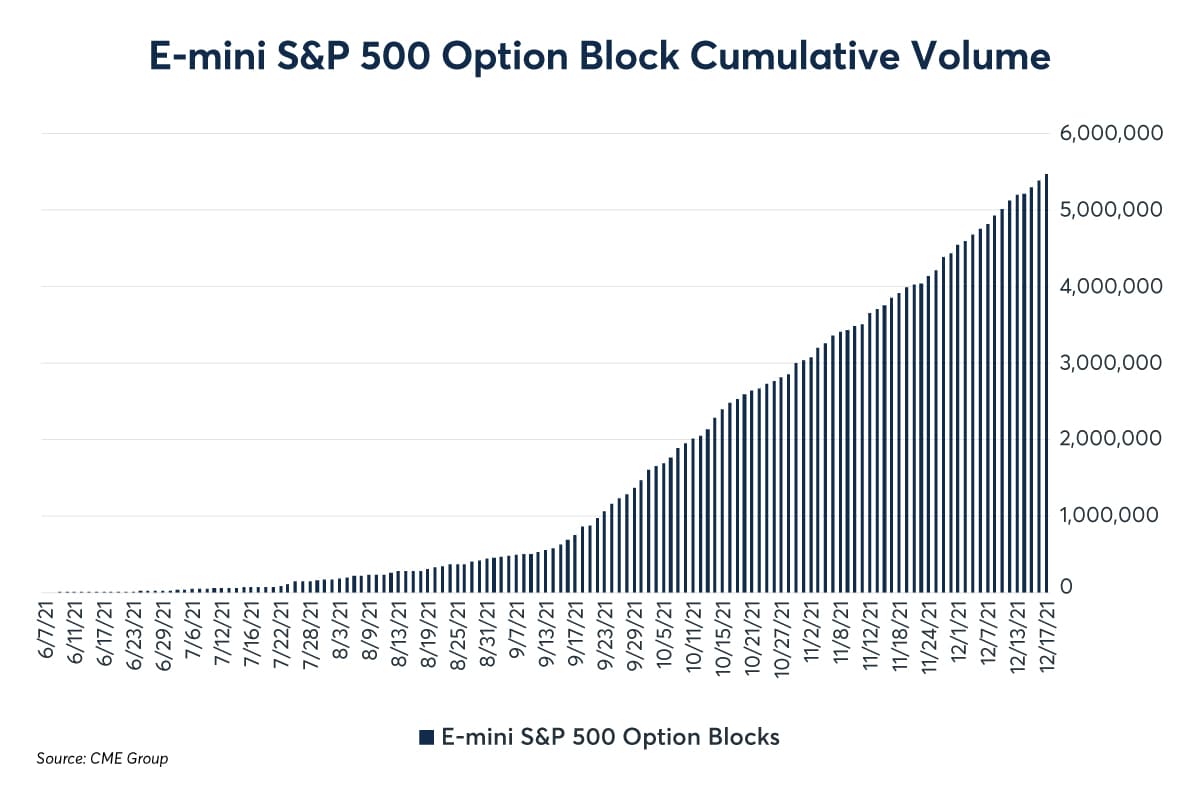

- Nearly 75,000 E-mini S&P 500 options block contracts were traded daily in Q4 at CME Group as traders watch fiscal and monetary policy decisions

If markets are climbing a wall of worry, there is no shortage of events driving the phenomenon. Federal Reserve policy could be changing with the market expecting three rate hikes in 2022, COVID-19 variants continue to emerge, and the U.S. midterm elections are less than a year away.

As in any time of uncertainty, market participants are looking for new tools to manage risk in equity markets.

Options Blocks

For institutional traders, the risks posed by rising inflation or a Fed rate hike can be significant and immediate. In June 2021, CME Group introduced E-mini S&P 500 (ES) options block trading to facilitate access to a market where the underlying E-mini S&P 500 futures provides around 10 times the liquidity traded across S&P 500 ETFs.

Block trades are privately negotiated futures or option trades – or combination transactions – that are permitted to be executed between two eligible counterparties. They are subject to minimum transaction size and time reporting requirements which vary according to the product, the type of transaction and the time of execution.

It should also be noted that the privately negotiated trade does not need to be exposed to the market before submitting the trade to the exchange. This means there is no breakup risk on the transaction once the two parties agree to a fair and reasonable price for their transaction, it is simply reported to CME for clearing within the 5-minute reporting window.

Over 4 million ES option contracts were traded via block in the fourth quarter through mid-December 2021 with an average daily volume of just under 75,000 contracts. There are 43 E-mini S&P 500 option expiries that span five years with thousands of strike prices available to suit hedging needs, (unlike the futures contract where there is one E-mini S&P 500 future, albeit with different expiries).

CME Group

There is considerable scope for use by market participants who are eligible to engage in block trading, from liquidity providers and intermediaries to asset managers and banks.

“Blocks offer a great deal of precision for institutional participants, and we’re pleased to see the wide adoption of these products continue to grow since launching in June,” says Tim McCourt, CME Group Global Head of Equity Index and Alternative Investment Products. “E-mini S&P 500 options block trading allows firms to lay off risk at a specific strike price and expiry date with a single large transaction, which is its core value proposition.”

Trading Quickly, with One Price

Robert Knopp is co-head of the S&P options trading team at the proprietary trading firm Optiver, which has a lengthy track record of block…

Read More: As Equity Market Risks Mount, Institutional Traders Look To Options