3 key things to know before opening a home equity line of credit

HELOC use rose as cash-out refis dropped

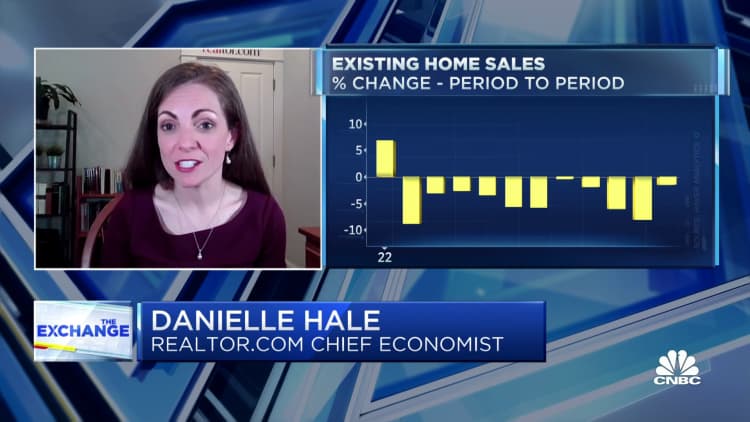

Last year, as mortgage rates climbed higher, accessing home equity by taking cash against it during refinancing (a so-called cash-out refi) became less appealing.

Rates on mortgages went from close to 3% at the beginning of 2022 to a peak of above 7% in the fall. Right now, the average on a 30-year fixed-rate mortgage is 6.21%, according to Mortgage News Daily.

As cash-out refis fell, HELOC use began to climb. Last year through September, lenders originated HELOCs totaling $214 billion, up from $159.5 billion during the same period in 2021, according to CoreLogic.

“In a low-rate environment, people were looking at cash-out refis,” Bellas said. “Now … a lot of people have a mortgage with a very low rate, so to do a cash-out refi, they’d be paying [a higher rate] on their full mortgage.”

“We’ve had quite a few people over the past 12 months … elect to go with the HELOC because of that,” Bellas said.

How HELOCs compare with other borrowing options

Generally, HELOCs come with low closing costs, compared with mortgages or home equity loans (which operate like other fixed-rate loans, with a set length of time to pay back). And if you have good credit, the rate you can get may be lower than what you’d pay for a personal loan or credit card balance.

Right now, rates on HELOCs are 7.75%, according to Bankrate. That compares with above 10% for personal loans (for consumers with high credit scores) and about 20% for credit cards, according to CreditCards.com.

I would not use a HELOC to buy frivolous things or things you can’t afford.

David Demming

President of Demming Financial Services

However, like your mortgage, a HELOC is a lien against your house — meaning that if you don’t repay as promised, the lender would have the right to foreclose on your house.

“I would not use a HELOC to buy frivolous things or things you can’t afford,” said certified financial planner David Demming, president of Demming Financial Services in Aurora, Ohio.

“It should be a short-term bill that you’re going to pay off within a finite period of time,” Demming said.

Here are three key things to consider before signing on the dotted line.

1. Variable interest rates make it tricky to budget

The interest rate on HELOCs is typically variable, meaning it moves up and down based on the so-called prime rate, which banks use as a basis to set rates on a variety of loans. While the Federal Reserve doesn’t control the prime rate, the one it does influence — the overnight lending rate among banks — ends up following suit.

“Because it’s variable, it can be tough to budget from month to month,” Bellas said.

Right now, the U.S. is in a rising rate environment, although that is expected to shift as time passes. The Fed’s rate-setting committee is meeting this week and is expected to raise that overnight lending rate by a quarter percentage point, which means the prime rate will generally tick higher — and so will HELOC rates.

2. It may be difficult to pay…

Read More: 3 key things to know before opening a home equity line of credit